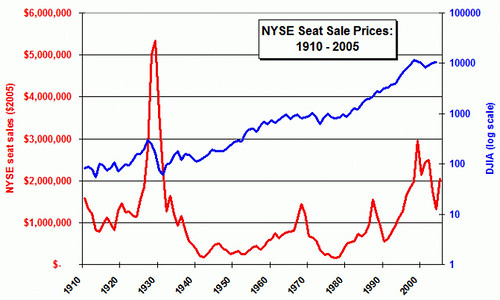

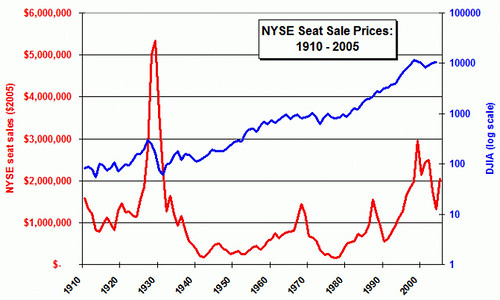

The Changing Value of a Seat on the NYSE

Paul Kedrosky at Infectious Greed has a chart showing the nominal and deflated price of a seat on the NYSE.

To tell the truth, I am surprised that a seat on the NYSE is valued so highly. My understanding is that the value of seats depends on volume and on the commission per transaction. Granted, volume may be growing, but I had thought commissions were under constant competitive pressure.

Anyway, I think Paul overstates the effect. $3m (in 2005 dollars) for a seat is tied for the 2nd highest price on his chart.

Given yesterday's record (in current dollars) $3-million sale of a New York Stock Exchange seat, I thought it would be interesting to show readers my own chart of inflation-adjusted historical NYSE prices. I average the prices for each year, and then bring it all to 2005 dollars. As you can see, we haven't yet returned to boom time levels, now are we anywhere near where NYSE seats changed hands back in the early 1930s:

To tell the truth, I am surprised that a seat on the NYSE is valued so highly. My understanding is that the value of seats depends on volume and on the commission per transaction. Granted, volume may be growing, but I had thought commissions were under constant competitive pressure.

Anyway, I think Paul overstates the effect. $3m (in 2005 dollars) for a seat is tied for the 2nd highest price on his chart.

<< Home